Cattle pricing during an economic crisis

| 4 min read

Photo: iStock/Getty Images Plus

Society has not yet discovered a better pricing mechanism than a free and open marketplace and is not likely to do so. Price signals the public demand for the product, with high prices signalling the demand for more, and the converse.

Does this mean that one should never seek to override price signals that are far higher or far lower than normal trading channel ranges?

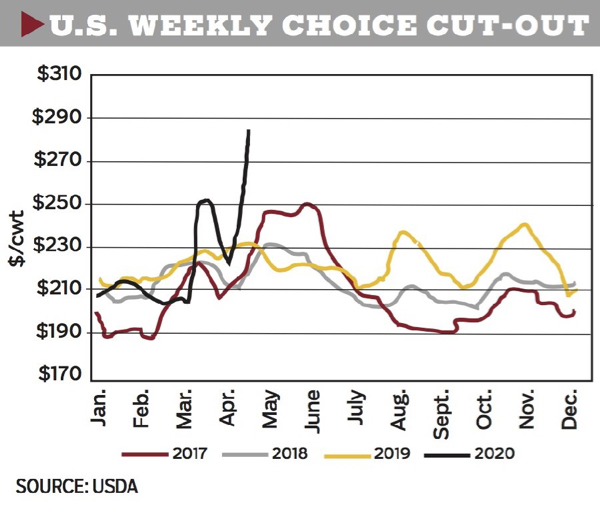

During the present COVID-19 pandemic we have seen cattle prices drop catastrophically while cut-out values soared. In this situation, the boxed beef processors are reaping unusually high returns while the cattle feeders sustain heavy losses. The high prices will be passed on to the consumers, justified by temporary scarcity, and the low prices will be passed back to the cow-calf producers, justified by necessity.

In other places there are checks and balances. Upper and lower daily limits are a feature of the futures markets and stock market managers can actually stop trading temporarily. These interventions with free market processes are necessary to retain good order and to prevent massive opportunistic windfalls on the one hand, and catastrophic losses on the other.

Several years ago, the cattle industry did something quite remarkable and best explained by a short discussion of the evolution of cattle pricing methods.

Before the advent — and common usage of — livestock scales, cattle were traded, of necessity, on a dollars per head basis. Here the advantage lay with the buyer who was more experienced than the seller in judging weight and quality.

With livestock scales becoming more common, cattle pricing slowly but surely shifted to a live weight basis. This removed any uncertainty about weight, but the experienced buyer still held an advantage in assessing the yield and quality of the animal and its carcass.

Later selling shifted further to a carcass weight and quality grade basis. Other measures were necessary to ensure accurate weights within the packing plant, but the system represented an important step forward.

Then, with the general decline from trading in sides and quarters, the industry moved another step forward to boxed beef and through the work of Canfax, cut-out values became widely understood.

In quick review, each step forward increased the precision of determining value and, by the same measure, fairness.

Finding a fair price

But when livestock pricing runs amok, some intervention is necessary to prevent severe losses or, equally, unearned profits.

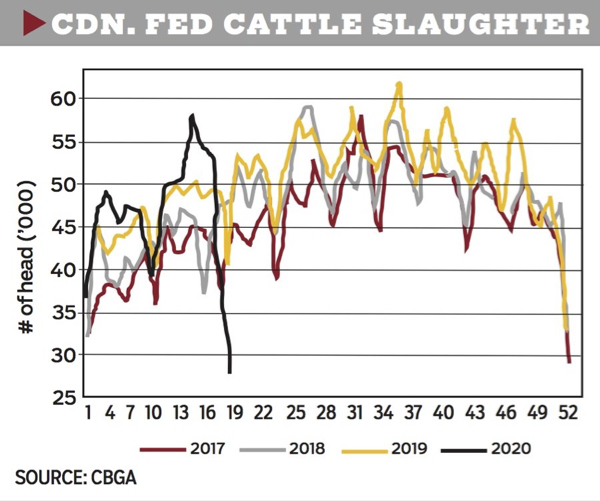

I attach two charts below to illustrate my point.

Photo: File

The first chart shows the sudden and sharp increase in the value of the product. In the other chart we see the sharp and large drop in the number of head marketed in that week. The data in the first chart is U.S. data, probably because Canadian data was not yet available.

Normally, one would expect that such a huge drop in the number of cattle marketed would be sufficient to justify sharply higher cattle prices and accordingly higher cut-out values. But these are not normal times and this was not the case as the prices are reported to have dropped $10 to $12 per cwt on a dressed-weight basis.

Is it not possible to set a “fair trading price” channel to contain these extremes when the extremes are caused by external and abnormal circumstances? Would that not improve the discovery of a fair price to the benefit of those who have no option but to sell? Is it too intrusive to require that intermediates not exploit an unnatural circumstance? Would anyone consider this intervention unjustified after witnessing what has already happened?

This would require some form of legislation but, given the difficulty of arguing for the right to exploit an extreme situation, such legislation should easily be enacted. This would also reduce the demand for public assistance in the form of subsidies. Can the industry not solve its own problems?

I do not propose to go into anything but general discussion. The details should be simple but would need to be worked out carefully to accomplish their purpose and to avoid unintended consequences. But, speaking generally, the provisions would state that in the case of an external emergency, the price for the cattle could not be less than “x” percent below the three-year average price paid in that market in that same week.

I have not taken the time to calculate prices precisely. The more important purpose is to outline the concept.

Quite obviously, given the deep integration of the North American market, this fair price provision would have to be agreed to on a North American basis.

There may be some flaws or unintended consequences in this concept and that is the reason I am proposing it for discussion. Do we really have to be victims?