Livestock Tax Deferral regions announced for drought-affected producers

| 1 min read

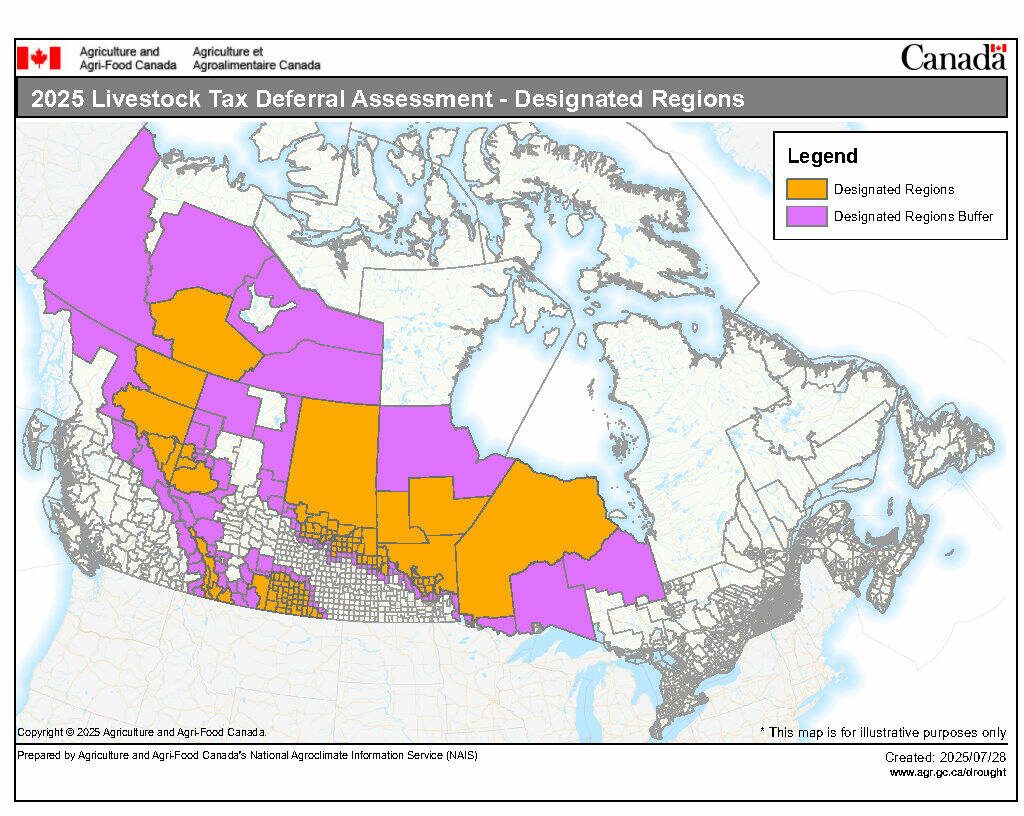

Cattle producers in large swaths of Western Canada and northwest Ontario will qualify for Livestock Tax Deferral in 2025, the federal agriculture minister announced on Monday.

“Canada’s new government is committed to supporting our livestock producers,” said Minister of Agriculture and Agri-Food Heath MacDonald in a news release.

Livestock Tax Deferral allows producers in prescribed areas to defer a portion of their income from sales until the next tax year if they are forced to sell at least 15 per cent of their breeding herd due to drought.

“Buffer zones” have been added to capture producers who are not in the prescribed zones but who may be experiencing similar adverse conditions.

“Weather, climate and production data from across Canada will continue to be monitored throughout the remainder of the season and regions will be added to the list when they meet the criteria,” the federal government said.

At the end of July, 71 per cent of the country was classified as abnormally dry or experiencing moderate to extreme drought according to Agriculture Agri-Food Canada data.

In the Pacific region, 91 per cent of agricultural land was classified as abnormally dry or experiencing moderate to extreme drought. In the Prairie provinces, 81 per cent of the agricultural landscape was considered abnormally dry or in moderate to extreme drought.