Tipping point seen for March canola

| 1 min read

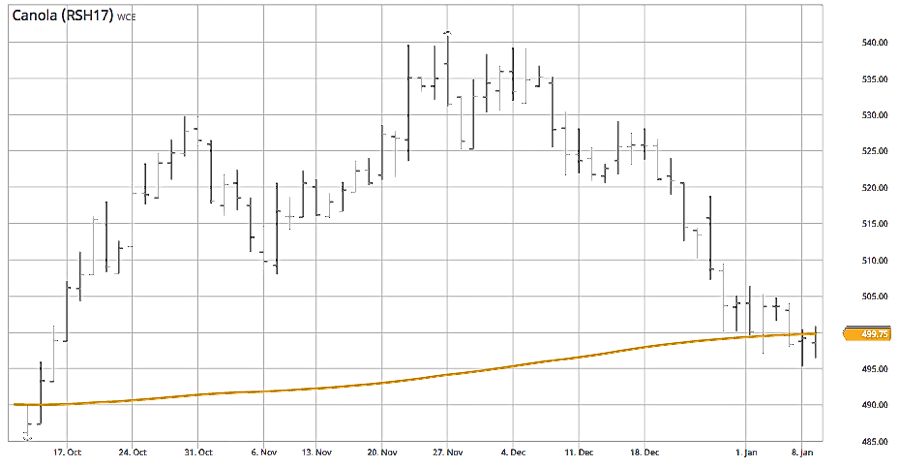

March 2017 canola, with the simple 200-day moving average included in orange. (Barchart.com)

CNS Canada — ICE Futures Canada canola futures find themselves at a bit of a tipping point from a chart standpoint, with the most active March contract settling right at the $500 per tonne mark on Tuesday.

In addition to being a psychological benchmark, $500 is also within 30 cents of the 200-day moving average of $499.70.

While canola has found itself in a bit of a downtrend since the beginning of December, the market has shown signs of stabilizing right in the middle of a wide $80 range in recent sessions.

Recent highs near $540 per tonne, hit in late November, mark the upper end of that wide range, while the summer lows near $460 provide the floor.

Analysts are generally of the opinion that a retest of either extreme is unlikely in the near term, with consolidation around current levels a greater possibility.

Nearby support comes in at around $495, with resistance at $502.

Over the past month, fund traders have moved from a net long position in canola to a small, but growing, net short position. While they have room to add to that short position, oversold indicators on the charts could result in some short-covering as well.

— Phil Franz-Warkentin writes for Commodity News Service Canada, a Winnipeg company specializing in grain and commodity market reporting. Follow him at @PhilFW on Twitter.